This 1991 research paper from the economics consulting firm DRI/McGraw Hill (“DRI”) was commissioned by Imperial Oil Limited (IOL), the Canadian subsidiary of Exxon, and was presented in IOL’s April 1991 “Discussion Paper on Global Warming Response Options.” This document is part of the ClimateFiles Imperial Oil document set, gleaned by DeSmog researchers from the Glenbow Imperial Oil Archive Collection.

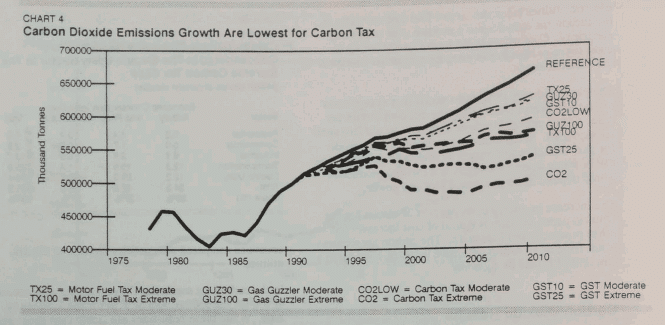

This paper lays out DRI’s findings regarding “the economic impacts and reduced CO2 levels resulting from selected government tax policy,” in particular focusing on four types of policies conducted at two different tax levels: a “Carbon Tax,” a “Goods and Services Tax,” a “Gas Guzzler Tax,” and a “Motor Fuel Tax.” DRI’s research concluded that the “Gas Guzzler” tax was “a particularly inefficient way of reducing CO2 emissions” with “by far the worst economic to CO2 reduction tradeoff of all the scenarios.”

At the other end of the spectrum, the Carbon Tax “causes the most direct impact on CO2 since the tax is in proportion to the emissions,” and was found to be the only pathway by which “the goal of flat emissions below 500 million tonnes” could be achieved.

This document also notes the importance of “international considerations” in achieving meaningful and economically sustainable emissions reductions, finding that “international cooperation is ultimately the deciding factor for a successful CO2 emission reduction plan.” The study also acknowledges the differentiated impact of climate change on developed vs. developing countries, stating that “The Third World, which has a major portion of its economy in the agricultural sector, has a much more serious economic exposure to global warming.”

The paper strongly encourages the possible efficacy of energy substitution as a means of reducing emissions, particularly “to substitute natural gas, nuclear and hdyropower [sic] for coal.” However, the research found that Canada’s provinces will experience the economic impacts of such a transition (and of a carbon tax generally) in unequal ways, “with energy-producing provinces such as Alberta facing the most severe adjustment costs…Quebec fares relatively better than other regions across all tax cases. Much of Quebec’s energy comes from hydro power, which is relatively unaffected by the four tax scenarios considered in this study.”